Last time we looked at Ayala Land, its Installment Contract Receivables (ICRs) problem had gotten worse and not better.

In 2018, things are looking better - much better. A lot of its ICRs were sold off to affiliates like BPI Family Bank and the overall level of ICRs have gone down substantially.

But credit quality remains a problem.

As a percentage of the remaining ICRs, total past due and impaired ICRs has not changed much.

Ayala Land's Real Estate Receivables Problem Has Gotten Worse, Not Better

The Philippine Real Estate Bubble Has Also Burst For... Ayala Land!

Search This Blog

Thursday, November 28, 2019

In 2018, Even Ayala Land Had a Less Than Stellar Year

Tuesday, November 19, 2019

Hong Kong Real Estate Prices Have Budged - But Only A Little - as of 3rd Qtr. 2019

On a monthly basis, Hong Kong Real Estate Prices have started showing some declines. But the declines are minimal. They have not reached correction levels of 10% or more.

But on a year-on-year basis, prices have merely flattened.

And the most expensive class, Class E (>160 sq. m.), has declined the most but have not reached the magnitudes of past declines.

Hong Kong House Prices Haven't Budged - Yet

How low can Hong Kong Property Prices Go? Some Clues from the Not Too Distant Past.

But on a year-on-year basis, prices have merely flattened.

Even by class, prices have flattened.

And the most expensive class, Class E (>160 sq. m.), has declined the most but have not reached the magnitudes of past declines.

Hong Kong House Prices Haven't Budged - Yet

How low can Hong Kong Property Prices Go? Some Clues from the Not Too Distant Past.

Wednesday, November 13, 2019

How Crazy is the Philippine Real Estate Market? Prices have Climbed Almost 50% Since Duterte Took Office!

Philippine house prices have gone parabolic. They have climbed 49.30% since President Duterte took office in the second half of 2016. Year-on-year price increase as of the 3rd Qtr 2019 is an astounding 21.20%. Prices have outpaced inflation by a wide margin, 139.88 percentage points.

How long can this go on? Not long, considering sales volumes dropped by more than 25% in 2018, indicating that more and more people cannot afford the high price levels.

Tuesday, November 5, 2019

The Not So Obvious Real Estate Bubbles

We all know about the high price of real estate in San Francisco and Los Angeles. Both metro areas boast one of the highest Median Home Price to Median Income ratios in the country. In 2018, the ratio for Los Angeles was an eye-watering 9.44 times median income. San Francisco was not too far behind with a ratio of 9.24 times median income. The sheer unaffordability of many homes has spawned a crisis of homelessness in those cities. Even tech workers, whose high wages have pushed up real estate prices in Silicon Valley, are forced to sleep in their cars and vans.

Yet those real estate markets are not technically in a bubble, and their ratios are just a shade over one standard deviation of their historical house price to income ratios. For instance, LA's historical ratio for the past 29 years has been at a lofty 7.11 times income, not too far from the current 9.44 times income. The same holds true for San Francisco. Its historical average is 7.57 versus the current 9.24 times income.

Even the global cities of Miami and New York are well within their historical averages. Miami's affordability ratio for 2018 was 6.06 times income - not far from its historical average of 4.71. New York's affordability ratio for 2018 was 5.25 times income - a shade below its historical average of 5.26 times income.

So where are the bubbilicious markets? Where have home prices strayed very far from their historical affordability ratios? Does Midland, TX come to mind? How about Lubbock, TX? Birmingham, AL? All these places had affordability ratios of less than 4 times income in 2018 - below the US national average of 4.13 times income. But all are solidly in bubble land with affordability ratios more than 2 times their historical averages since 1990.

Midland, TX ratio stood at 3.08 in 2018 - almost three standard deviations away from its historical mean of just 2.33 times income. The probability of the ratio going higher is just 0.17%. Lubbock's ratio of 3.03 times income in 2018 is 2.58 standard deviations away from its historical mean of just 2.59 times income, giving an upside probability of 0.49%. Birmingham, AL's upside is slightly better 0.64% because its 2018 affordability ratio of 3.86 times income is 2.49 standard deviations away from its historical mean of 3.34 times income.

According to data tabulated by Harvard University's Joint Center for Housing Studies, 37 metro areas out of 382 metros are in bubble markets:

None of them, with the exception of San Jose, CA of Silicon Valley, are in obvious real estate bubbles.

Will their affordability ratios normalize or have they reached a permanently higher plateau? Only time will tell. But if they do, the results can be just as catastrophic for the homeowners.

Only three metro areas out of 382 are in a depression. Their affordability ratios in 2018 were way below their historical mean:

Source: State of the Nation's Housing, Joint Center for Housing Studies, Harvard University

Yet those real estate markets are not technically in a bubble, and their ratios are just a shade over one standard deviation of their historical house price to income ratios. For instance, LA's historical ratio for the past 29 years has been at a lofty 7.11 times income, not too far from the current 9.44 times income. The same holds true for San Francisco. Its historical average is 7.57 versus the current 9.24 times income.

Even the global cities of Miami and New York are well within their historical averages. Miami's affordability ratio for 2018 was 6.06 times income - not far from its historical average of 4.71. New York's affordability ratio for 2018 was 5.25 times income - a shade below its historical average of 5.26 times income.

| Median House Price to Median Income Ratios | ||||

| Metropolitan Area | 2018 | Mean | Std Dev | Z Score |

| Los Angeles-Long Beach-Anaheim, CA | 9.44 | 7.11 | 2.14 | 1.09 |

| San Francisco-Oakland-Hayward, CA | 9.24 | 7.57 | 1.65 | 1.01 |

| Miami-Fort Lauderdale-West Palm Beach, FL | 6.06 | 4.71 | 1.54 | 0.88 |

| New York-Newark-Jersey City, NY-NJ-PA | 5.25 | 5.26 | 1.17 | -0.01 |

So where are the bubbilicious markets? Where have home prices strayed very far from their historical affordability ratios? Does Midland, TX come to mind? How about Lubbock, TX? Birmingham, AL? All these places had affordability ratios of less than 4 times income in 2018 - below the US national average of 4.13 times income. But all are solidly in bubble land with affordability ratios more than 2 times their historical averages since 1990.

Midland, TX ratio stood at 3.08 in 2018 - almost three standard deviations away from its historical mean of just 2.33 times income. The probability of the ratio going higher is just 0.17%. Lubbock's ratio of 3.03 times income in 2018 is 2.58 standard deviations away from its historical mean of just 2.59 times income, giving an upside probability of 0.49%. Birmingham, AL's upside is slightly better 0.64% because its 2018 affordability ratio of 3.86 times income is 2.49 standard deviations away from its historical mean of 3.34 times income.

According to data tabulated by Harvard University's Joint Center for Housing Studies, 37 metro areas out of 382 metros are in bubble markets:

None of them, with the exception of San Jose, CA of Silicon Valley, are in obvious real estate bubbles.

Will their affordability ratios normalize or have they reached a permanently higher plateau? Only time will tell. But if they do, the results can be just as catastrophic for the homeowners.

Only three metro areas out of 382 are in a depression. Their affordability ratios in 2018 were way below their historical mean:

- Cape Girardeau, MO

- Beckley, WV

- Decatur, IL

Tuesday, October 15, 2019

Who Are the Missing American Workers?

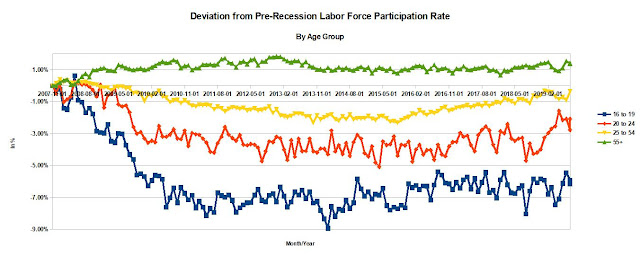

Last year, we estimated that there were almost 8 million workers missing from the labor force. Because of job growth, that number is down slightly to 7.4 million.

With the exception of DC and MA, most states have not recovered their pre-recession Labor Force Participation Rates (LFPR).

Prime Age Workers (those aged 25 to 54) are within a hair's breadth of their pre-recession LFPRs, indicating that labor markets may start to tighten very soon. However, wage inflation may be muted for the time being. Why? There are huge pools of labor waiting to take up the slack, particularly in the 20-24 and teenage (16 to 19) age groups. Their LFPRs are still significantly below their pre-recession peaks. The oldest age bracket (55+) actually have a higher participation rates post-recession than pre-recession, indicating that many of them are not ready to retire and/or are working part-time jobs. All these factors serve to suppress wage inflation.

In terms of absolute numbers, there are at least 1.5 million young workers missing from the labor force, plus another 1.3 million older workers hanging on to the labor force.

It would take several more years of sustained job growth to reduce this labor slack.

With the exception of DC and MA, most states have not recovered their pre-recession Labor Force Participation Rates (LFPR).

Prime Age Workers (those aged 25 to 54) are within a hair's breadth of their pre-recession LFPRs, indicating that labor markets may start to tighten very soon. However, wage inflation may be muted for the time being. Why? There are huge pools of labor waiting to take up the slack, particularly in the 20-24 and teenage (16 to 19) age groups. Their LFPRs are still significantly below their pre-recession peaks. The oldest age bracket (55+) actually have a higher participation rates post-recession than pre-recession, indicating that many of them are not ready to retire and/or are working part-time jobs. All these factors serve to suppress wage inflation.

In terms of absolute numbers, there are at least 1.5 million young workers missing from the labor force, plus another 1.3 million older workers hanging on to the labor force.

It would take several more years of sustained job growth to reduce this labor slack.

Tuesday, October 8, 2019

US Home Prices Have Softened Somewhat. How Much Lower Should They Go?

Prices of new homes sold in the US have softened somewhat.

As of August 2019, the average prices of new homes sold in the US have dropped 2.2%, from $323,125 in 2018 to just $316,075 today. Incomes have also risen. We estimate the median household income to be $65,074 in 2019, up 3.0% from $63,179 in 2018 and up 6.44% from $61,136 in 2019. As a result, the house price to income ratio now stands at an affordable 4.86 times income, down from its recent peak of 5.26 times income in 2017.

But house prices are still a long way from affordable. The current house price to income ratio is more than one standard deviation above the long-term mean of 4.23. The same holds true for existing homes and all homes both new and existing.

So how much further do home prices have to fall to become affordable at current incomes? About 9.4% for all homes, from the current price of $273,859 to $248,160. The drop in new home prices will have to be even steeper: almost 13%.

Conversely, if home prices remain flat, how much further do incomes have to rise to reach their long-term affordability? For all homes, this is around 10.4%. To afford a new home, incomes have to rise 14.9%.

If incomes rise by the current rate of 3.0% a year, it will take 3-5 years before home prices hit their long-term affordability ratios. If prices continue to drop at the current rate of just 2.0% a year, it will take much longer: 5-7 years.

We could be in for a long wait.

As of August 2019, the average prices of new homes sold in the US have dropped 2.2%, from $323,125 in 2018 to just $316,075 today. Incomes have also risen. We estimate the median household income to be $65,074 in 2019, up 3.0% from $63,179 in 2018 and up 6.44% from $61,136 in 2019. As a result, the house price to income ratio now stands at an affordable 4.86 times income, down from its recent peak of 5.26 times income in 2017.

But house prices are still a long way from affordable. The current house price to income ratio is more than one standard deviation above the long-term mean of 4.23. The same holds true for existing homes and all homes both new and existing.

| Home Type | 2019 Median Sales Price | 2019 Median Household Income (Estimated) | 2019 House Price to Income Ratio (HPI) | Mean House Price to Income Ratio (Mean HPI) |

| New Homes | $316,075 | $65,074 | 4.86 | 4.23 |

| Existing Homes | $268,513 | $65,074 | 4.13 | 3.73 |

| New and Existing Homes (Weighted Average) | $273,859 | $65,074 | 4.21 | 3.81 |

So how much further do home prices have to fall to become affordable at current incomes? About 9.4% for all homes, from the current price of $273,859 to $248,160. The drop in new home prices will have to be even steeper: almost 13%.

Conversely, if home prices remain flat, how much further do incomes have to rise to reach their long-term affordability? For all homes, this is around 10.4%. To afford a new home, incomes have to rise 14.9%.

If incomes rise by the current rate of 3.0% a year, it will take 3-5 years before home prices hit their long-term affordability ratios. If prices continue to drop at the current rate of just 2.0% a year, it will take much longer: 5-7 years.

We could be in for a long wait.

Wednesday, October 2, 2019

The Case of 8990 Holdings Inc.'s Disappearing Past Due Installment Contract Receivables Gets Curiouser and Curiouser

In 2014, we first broached the idea that 8990's past due installment contract receivables (ICRs) problem was about to explode. Since then, past due and/or impaired ICRs ballooned from just 0.32% of total ICRs in 2013 to a peak of 18.85% of total ICRs in 2015. Since then, the company has managed to trim its receivables problem to 10.12% in 2016 and to just 2.40% in 2017. In 2018, the receivables problem worsened, almost doubling to 4.67% of total ICRs.

Total ICRs are also down significantly since 2017. In 2018, ICRs were just Php 17.6 billion, down almost 20% from Php 21.2 billion in 2017.

Reduced Disclosure

But the company failed to provide an aging analysis of its past due but not impaired ICRs for 2018.

Level 3 Assets

It also decided to emulate Vista Land by classifying almost all of its ICRs as Level 3 Assets. Beginning in 2017, it classified Php 19.9 billion in 2017 and Php 16.1 billion ICRs in 2018 as Level 3.

What is meant by Level 3?

According to its Fair Value Hierarchy, 8990's Level 3 Assets are assets in which the inputs for those assets are not based on observable market data. The inputs for Level 1 Assets are market prices for those assets. The inputs for Level 2 Assets are more indirect. The exact definitions are as follows:

Dearborn Resources Holdings, Inc.

In early 2018, 8990 Holdings sold a huge chunk of its ICRs to an entity called Dearborn Resources and Holdings, Inc. (Dearborn). The sale was without recourse. But the sale was much more complicated than a simple transaction. From 8990's 2018 Annual Report, we get this tidbit:

This disclosure raises a lot of questions:

Read:

Has the Philippine Real Estate Bubble Already Burst?

8990 Holdings, Inc.: The Case of the Disappearing Past Due Installment Contract Receivables

The Philippine Real Estate Bubble Has Already Burst for HOUSE (8990 Holdings, Inc.)

Total ICRs are also down significantly since 2017. In 2018, ICRs were just Php 17.6 billion, down almost 20% from Php 21.2 billion in 2017.

Reduced Disclosure

But the company failed to provide an aging analysis of its past due but not impaired ICRs for 2018.

Level 3 Assets

It also decided to emulate Vista Land by classifying almost all of its ICRs as Level 3 Assets. Beginning in 2017, it classified Php 19.9 billion in 2017 and Php 16.1 billion ICRs in 2018 as Level 3.

What is meant by Level 3?

According to its Fair Value Hierarchy, 8990's Level 3 Assets are assets in which the inputs for those assets are not based on observable market data. The inputs for Level 1 Assets are market prices for those assets. The inputs for Level 2 Assets are more indirect. The exact definitions are as follows:

Level 1: quoted prices (unadjusted) in active markets for identical assets or financialNow what exactly is an unobservable input to an ICRs of 8990? ICRs are essentially a loan from the developer (8990 Holdings) to the buyer so that the buyer can purchase the residential unit from the developer. The ICR is collateralized by the title to the property itself and is held by the developer until the ICR is paid off by the buyer. All the inputs are observable: the amount of the ICR, the monthly installment, the imputed interest rate, etc. The ICRs have to be simple enough for the buyer to understand what he/she is buying. Otherwise, if the ICRs are structured in a complicated fashion, the buyer will not buy the property. 8990 Holdings customers are simple end-users. They buy the homes they will live in. And most are not financially sophisticated buyers. So valuing the ICRs is not rocket science. The ICRs should be classified as Level 1. All of them.

liabilities that an entity can access at the measurement date;

Level 2: inputs other than quoted prices included within Level 1 that are observable

for the asset or liability, either directly (i.e., as prices) or indirectly (i.e., derived from

prices); and,

Level 3: inputs for the asset or liability that are not based on observable market data

(unobservable inputs).

Dearborn Resources Holdings, Inc.

In early 2018, 8990 Holdings sold a huge chunk of its ICRs to an entity called Dearborn Resources and Holdings, Inc. (Dearborn). The sale was without recourse. But the sale was much more complicated than a simple transaction. From 8990's 2018 Annual Report, we get this tidbit:

"On January 29, 2018, the Group entered into an agreement with Dearborn Resources and Holdings, Inc. (Dearborn) to sell its contracts-to-sell (CTS), with a total face value or principal amount of up to P10.0 billion, without recourse. Subsequent to the sale of the CTS, Dearborn shall be primarily responsible for servicing, administrating, and collecting these receivables. On the same date, the Group was appointed as the sub-servicer and the remarketing agent of Dearborn. Total amount of CTS sold to Dearborn in 2018 is P10.0 billion. The related receivable arising from this transaction amounting to P165.5 million is presented as part of Other receivables as at December 31, 2018.

On December 29, 2017, a loan facility agreement between Dearborn and certain lenders was executed to provide a loan facility in the aggregate principal amount of P1.4 billion for the purpose of partially financing Dearborn’s acquisition of certain CTS of the Group. Under the loan facility agreement, the Parent Company also committed to lend Dearborn the principal amount of up to but not in excess of P300.0 million which bears 16% interest per annum, payable monthly. The loan granted under the facility agreement is unsecured and has a term of five years counting from the date of initial drawdown. However, the principal amount of the loan and any related accrued interest will be due and demandable in the event of default. As of December 31, 2018, the Parent Company has already extended P314.0 million financing to Dearborn. Interest earned and received from this loan receivable amounted to P16.2 million, which is presented as part of Interest income under Other Operating Income in the 2018 consolidated statement of profit or loss (see Note 23.1)."

This disclosure raises a lot of questions:

- What is Dearborn Resources Holdings, Inc.? A firm with the ability to buy ICRS with a total face value of Php 10 billion has to be a substantially well capitalized firm. Is it a financial firm, a vulture fund, a subsidiary of a universal bank? It seems to have no website, no listed owners. It's an unknown entity.

- Were the receivables sold at a loss? How much cash did 8990 actually receive on the sale? The face value is Php 10.0 billion and the remaining receivable from Dearborn is Php 165.5 million. Maybe I'm not reading this correctly but the step-by-step mechanics of the transaction are not clear.

- Is Dearborn related to 8990? Do or did they have common stockholders?

- Why is 8990 lending Php 300.0 million to Dearborn on an unsecured basis if this is an arm-length transaction with a completely independent entity? 8990's management would not lend Dearborn Php 300.0 million unless they knew the Dearborn and its management well and they have had an existing relationship with that firm.

Read:

Has the Philippine Real Estate Bubble Already Burst?

8990 Holdings, Inc.: The Case of the Disappearing Past Due Installment Contract Receivables

The Philippine Real Estate Bubble Has Already Burst for HOUSE (8990 Holdings, Inc.)

Tuesday, October 1, 2019

While Philippine House Prices Rose Sharply in 2018, Sales Volumes Fell. Is this the Start of the Real Estate Crash?

In a classic technical analysis indicator, Philippine Home Prices rose by 15.40% in 2018 while sales volumes fell by a startling 25.55% over the previous year, indicating that fewer and fewer people could afford the higher prices.

Despite this, House Prices, at least in the Makati CBD, continued to rise even further, by 10.07% as of the second quarter of 2019.

Today, the BSP reported that its Residential Real Estate Price Index (RREPI) fell by 2.08% on a Philippine-wide basis and across all types. Prices in areas outside the National Capital Region (Ex-NCR) fell while real estate prices in the National Capital Region (NCR) stayed about flat.

Although this is only a slowdown and a very marginal one at that, it could lead to a crash as the market clears.

This is Even Nuttier! When's the Crash? Philippine Home Prices Have Gone Even More Parabolic!

Despite this, House Prices, at least in the Makati CBD, continued to rise even further, by 10.07% as of the second quarter of 2019.

Today, the BSP reported that its Residential Real Estate Price Index (RREPI) fell by 2.08% on a Philippine-wide basis and across all types. Prices in areas outside the National Capital Region (Ex-NCR) fell while real estate prices in the National Capital Region (NCR) stayed about flat.

Although this is only a slowdown and a very marginal one at that, it could lead to a crash as the market clears.

This is Even Nuttier! When's the Crash? Philippine Home Prices Have Gone Even More Parabolic!

Tuesday, September 24, 2019

Australia Has Been Deleveraging Since Year-End 2016

Australia has been deleveraging since year-end 2016. The gap between Credit -to-GDP Growth and its long-term trend has been growing wider ever since. Last time this happened was in March 2010 and it remained that way for over five years - June 2015.

Source: https://www.bis.org/statistics/c_gaps.htmg

Saturday, September 21, 2019

Unemployment is Low But Wage Inflation is Low Too. Which States Have the Tightest Labor Markets?

Last month, the unemployment rate was an astounding 3.7% - a rate not seen since September 1969.

But for most of the last decade, wage inflation has been low to almost non-existent. Only recently have wages started to creep up.

One reason? Both the Civilian Labor Force Participation Rates (LFPR) and Civilian Employment to Population Ratios (EPR) have yet to reach their pre-recession peak in 2007 and their absolute peak in 2000, during the height of the dotcom bubble.

The gaps are substantial, involving millions of missing workers. For instance, if last month's LFPR were 65.70% (2007 pre-recession peak) instead of an actual 63.20%, there would be 6.5 million more workers counted in the labor force today.

If we had posted an EPR of 63.00% (2007 peak) instead of the current 60.90%, there would be 5.6 million more workers employed today.

Instead, all those workers have gone missing from the labor force. One reason why wage inflation has not been stronger is that all these missing workers are slowly starting to come back to the labor force and kept a lid on wage inflation.

But that is starting to change. Some states have reached, if not surpassed, their pre-recession LFPRs and EPRs and are starting to experience a shortage of workers.Where are those shortages? DC and Massachussets come to mind (in green). Thirteen other states (in yellow) are getting close, with less than 2% of their civilian non-institutional populations (CINP) labeled as missing. Sadly, five states (in red) have more than 5% of their workers categorized as missing from the labor force.

In terms of EPR, DC and MA have actual shortages (in green) while six other states have less than 2% of their CINPs categorized as missing (in yellow). Seven states have more than 5% of their CINPs categorized as missing.

If you add the percentage of missing workers to the state's unemployment rate, we get a closer picture of where the true unemployment rates lie. Again, DC and MA (in green) have very low true unemployment rates, while four other states (in yellow) have true unemployment rates of less than 5%. Seven states (in red) have true unemployment rates of 12% or more of their CINPs.

But for most of the last decade, wage inflation has been low to almost non-existent. Only recently have wages started to creep up.

One reason? Both the Civilian Labor Force Participation Rates (LFPR) and Civilian Employment to Population Ratios (EPR) have yet to reach their pre-recession peak in 2007 and their absolute peak in 2000, during the height of the dotcom bubble.

The gaps are substantial, involving millions of missing workers. For instance, if last month's LFPR were 65.70% (2007 pre-recession peak) instead of an actual 63.20%, there would be 6.5 million more workers counted in the labor force today.

If we had posted an EPR of 63.00% (2007 peak) instead of the current 60.90%, there would be 5.6 million more workers employed today.

Instead, all those workers have gone missing from the labor force. One reason why wage inflation has not been stronger is that all these missing workers are slowly starting to come back to the labor force and kept a lid on wage inflation.

But that is starting to change. Some states have reached, if not surpassed, their pre-recession LFPRs and EPRs and are starting to experience a shortage of workers.Where are those shortages? DC and Massachussets come to mind (in green). Thirteen other states (in yellow) are getting close, with less than 2% of their civilian non-institutional populations (CINP) labeled as missing. Sadly, five states (in red) have more than 5% of their workers categorized as missing from the labor force.

In terms of EPR, DC and MA have actual shortages (in green) while six other states have less than 2% of their CINPs categorized as missing (in yellow). Seven states have more than 5% of their CINPs categorized as missing.

If you add the percentage of missing workers to the state's unemployment rate, we get a closer picture of where the true unemployment rates lie. Again, DC and MA (in green) have very low true unemployment rates, while four other states (in yellow) have true unemployment rates of less than 5%. Seven states (in red) have true unemployment rates of 12% or more of their CINPs.

Monday, September 16, 2019

Both China and Hong Kong Just Started Deleveraging - Last Year

Credit to GDP growth has dipped below the trendline for both countries.

Source:

https://www.bis.org/statistics/c_gaps.htm

Source:

https://www.bis.org/statistics/c_gaps.htm

Thursday, September 12, 2019

This is Even Nuttier! When's the Crash? Philippine Home Prices Have Gone Even More Parabolic!

Philippine Home Prices have gone parabolic. Home prices are now 125.63% above their inflation-adjusted basis.

On a year-over-year basis, home prices have increased almost 20% year-on-year since the second quarter of 2018. Since the third quarter of 2016, home prices have climbed 43.39%. This pace is unsustainable and will not last.

On a year-over-year basis, home prices have increased almost 20% year-on-year since the second quarter of 2018. Since the third quarter of 2016, home prices have climbed 43.39%. This pace is unsustainable and will not last.

Thursday, September 5, 2019

Hong Kong House Prices Haven't Budged - Yet

But the data is only up to the second quarter of 2019. And the protests only started on a massive scale in the middle of June 2019.

Source: Hong Kong Rating and Valuation Department

Tuesday, August 20, 2019

This is Nuts. When's the Crash? Philippine Home Prices Have Gone Parabolic!

Philippine Home Prices have gone parabolic. Home prices are now 116.03% above their inflation-adjusted basis.

Tuesday, August 13, 2019

New Zealand Real Estate Market: Is it a Unicorn? Prices Keep Rising While Other Markets Fall

House Prices in New Zealand continue to rise. In the first quarter of 2019, it rose 3.5% year-over-year.

This is in sharp contrast to its next door neighbor, Australia, where house prices in the first quarter of 2019 have dropped 7.7% year-over-year and are down 8.27% from their peak in the fourth quarter of 2017.

In real terms, New Zealand's uptrend in home prices seems to have accelerated and verges on the parabolic, vastly outpacing real disposable income.

This is in sharp contrast to its next door neighbor, Australia, where house prices in the first quarter of 2019 have dropped 7.7% year-over-year and are down 8.27% from their peak in the fourth quarter of 2017.

In real terms, New Zealand's uptrend in home prices seems to have accelerated and verges on the parabolic, vastly outpacing real disposable income.

The ratio of real house prices to real disposable income seems to have reached a permanently high plateau. The ratio is now 2.29 standard deviations from the mean of 76.82%, implying a probability of only 1.10% that the ratio will go even higher. In other words, it's firmly in bubble territory and seems to be staying there.

Sunday, August 11, 2019

Is Trump's Immigration Crackdown Finally Starting to Work?

I know one data point does not make a trend but it's starting to look like foreign born workers are starting lose out in a Trump economy. The proportion of employed foreign workers has been dropping for five months straight since they peaked in February 2019.

Tuesday, August 6, 2019

US Real Estate Market: This is a Slowdown and Not a Crash

This trend is borne out by the market for existing homes where prices are still going up as volumes dip, indicating fewer and fewer people can afford the higher home prices.

The opposite trend is true in the market for new homes. Volumes are up while prices are down a mere 2.60% from their peak in 2018.

But since the market for existing homes is almost eight times the size of the new homes market, the existing homes market trend is the dominant one.

Are we in for another housing crash. In a word, no. Not yet. This is just a slowdown and not a crash.

Wednesday, July 31, 2019

How Far Does the Canadian Housing Market Have to Fall to Reach Equilibrium?

In 2017, the Canadian Housing Market peaked in the second quarter of 2017. Since then, prices have declined modestly, by just 5.28% as of the first quarter of 2019. So, the housing market has slowed down and not quite reached correction levels of a 10% decline.

House prices could still fall by 28.00% to align themselves with the growth in personal disposable incomes. In terms of the ratio of real house prices to real personal disposable incomes, house prices have fallen even more: 7.70% from Q2 of 2017 to Q1 of 2019. The ratio is now almost within two standard deviations from the historical mean. In other words, they less extremely overvalued and are just starting to enter merely overvalued territory. The probability of house prices being any higher is now only 1.35% instead of 1.30% the last time we looked. The improvement is infinitesimally small.

If the ratio does revert to the mean, house prices could fall by 31.56%.

How low can Canadian Property Prices Go?

How Overheated are the Real Estate Markets of Canada, Australia, and New Zealand?

House prices could still fall by 28.00% to align themselves with the growth in personal disposable incomes. In terms of the ratio of real house prices to real personal disposable incomes, house prices have fallen even more: 7.70% from Q2 of 2017 to Q1 of 2019. The ratio is now almost within two standard deviations from the historical mean. In other words, they less extremely overvalued and are just starting to enter merely overvalued territory. The probability of house prices being any higher is now only 1.35% instead of 1.30% the last time we looked. The improvement is infinitesimally small.

If the ratio does revert to the mean, house prices could fall by 31.56%.

How low can Canadian Property Prices Go?

How Overheated are the Real Estate Markets of Canada, Australia, and New Zealand?

Saturday, July 27, 2019

It's Official: Economic Recovery in the Great Depression is Faster than the Great Recession's

The economic recovery of the Great Recession has been almost

imperceptible to most Americans. On a per capita bais, real GDP per

Capita grew by 11.55% in the past twelve years - or roughly a compounded

annual average growth rate of only 0.91% per annum. This is far less

than the so-called "Hindu Rate of Growth" threshold of 1.30% per annum. This growth rate is so slow that it is almost imperceptible.

In 2019, something extraordinary happened. Those who survived the Great Depression in 1941 (twelve years after the onset of the Great Depression) will be substantially better of than the survivors of the Great Recession in 2019. Real GDP Per Capita for Great Recession survivors would have grown by another anemic 0.91% per annum in 2019. But for survivors of the Great Depression era, their incomes per capita would have grown by an astounding 15.95% in just one year. Moreover, that trend will only accelerate in the next two years. By 1943, Great Depression survivors will be almost 34.48% richer than they were in 1941.

Can we expect the same for survivors of the Great Recession in the next two years? It's possible but not probable.

In 2019, something extraordinary happened. Those who survived the Great Depression in 1941 (twelve years after the onset of the Great Depression) will be substantially better of than the survivors of the Great Recession in 2019. Real GDP Per Capita for Great Recession survivors would have grown by another anemic 0.91% per annum in 2019. But for survivors of the Great Depression era, their incomes per capita would have grown by an astounding 15.95% in just one year. Moreover, that trend will only accelerate in the next two years. By 1943, Great Depression survivors will be almost 34.48% richer than they were in 1941.

Can we expect the same for survivors of the Great Recession in the next two years? It's possible but not probable.

Wednesday, July 24, 2019

When Does the Overheated Real Estate Market of Australia Reach Equilibrium?

Last year, the real estate bust hit Australia. Prices have declined 8.27% since they peaked in the last quarter of 2017. But the decline is still a shade below a 10% correction and has not yet reached bear market proportions of a decline of 20% or more.

House prices could still fall by 38.56% to reach their inflation-adjusted levels. In relation to incomes, the ratio of real house prices to real personal disposable incomes have fallen significantly. That ratio is now within two standard deviations from the historical mean. In other words, they are now just overvalued and not extremely overvalued. The probability of house prices being any higher is now a healthier 5.22% instead of 1.4% the last time we looked.

If the ratio does revert to the mean, house prices could still fall by 30.67% in real terms.

How low can Australian Property Prices Go? Let Me Count the Ways

How Overheated are the Real Estate Markets of Canada, Australia, and New Zealand?

House prices could still fall by 38.56% to reach their inflation-adjusted levels. In relation to incomes, the ratio of real house prices to real personal disposable incomes have fallen significantly. That ratio is now within two standard deviations from the historical mean. In other words, they are now just overvalued and not extremely overvalued. The probability of house prices being any higher is now a healthier 5.22% instead of 1.4% the last time we looked.

If the ratio does revert to the mean, house prices could still fall by 30.67% in real terms.

How low can Australian Property Prices Go? Let Me Count the Ways

How Overheated are the Real Estate Markets of Canada, Australia, and New Zealand?

Subscribe to:

Comments (Atom)