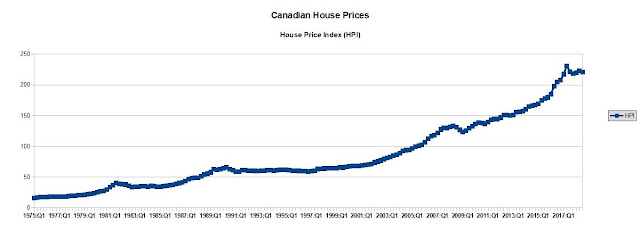

Eight months ago, we speculated that the Canadian Property Market was due for a bust.

Today, that reality has come ever closer. So far, as of the third quarter of 2018, property prices have

declined by 4.24% since they peaked in the second quarter of 2017.

Property Prices have also leapfrogged incomes so much that the

relationship of Property Prices to Income is way out of whack. On

average, the ratio of Real House Prices to Real Personal Disposable

Income (data from the International House Price Database

maintained by the Dallas Federal Reserve) since 1975 has been 95% of

Real Personal Disposable Income with a Standard Deviation of 19%. As

of the 3rd qtr of 2018, Real House Prices now stand at 142% of Real

Personal Disposable Income. This represents more than 2 Standard

Deviations above the historical mean. Assuming a normal distribution,

there is only a 1.3% probability that the property market could go even

higher. If Real House Prices revert to the mean, as they often do, Canada could be in for a property decline of 33.58% from current

levels. But markets always tend to overshoot to the downside. If the real estate

boom of the past two decades caused prices to surge way past anything

that reflect fundamentals, a panic could set in on the downside and

cause prices to drop to levels not seen in a generation.

How Overheated are the Real Estate Markets of Canada, Australia, and New Zealand?

No comments:

Post a Comment