Much has been said about how

slow and expensive the Internet is in the Philippines. Internet activists like to blame

IP Peering. The telcos themselves say that the

process of putting up cell towers is very slow and full of red tape.

Dividend Policy:

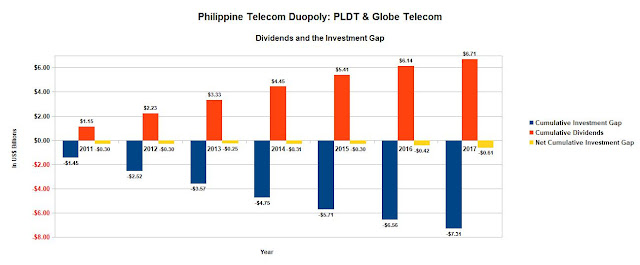

But there is another reason why the telcos have not kept pace with market demand: They take out all the money they make and then some.

From 2011 to 2017, the duopoly made Php 274.86 billion (roughly US$ 6.16 billion during the same period) but dividended out to its commons shareholders approximately Php 298.71 billion (roughly US$ 6.71 billion) over the same time period, resulting in an overall dividend payout ratio of 108.68%. This dividend payout ratio is more consistent with that of a cash cow being milked than that of a fast growing company seeking to reinvest its profits to build up its business. The chief culprit was PLDT which paid out Php 228.28 billion in dividends during this period, which is 118.59% more than its Php 192.50 billion in net income over the same time frame. Yes, Globe Telecom had a lower dividend payout ratio - but only slightly. It paid out Php 70.43 billion or 85.51% of its Php 82.36 billion in net income.

|

| Source: PLDT & Globe Telecom Financial Statements |

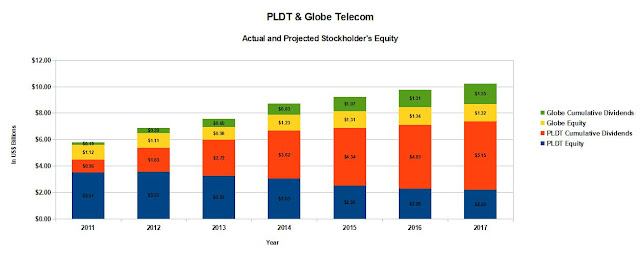

As a result, their combined Total Stockholder's Equity base has gone down instead of up. Since 2011, Total Stockholder's Equity of the two telcos has gone down 11.34% to Php 177.56 billion as of 2017 from Php 200.26 billion as of year-end 2011.

The decline was due to PLDT. Its equity base went down 26.89% from Php 151.83 billion in 2011 to just Php 111.00 billion six years later. In contrast, Globe Telecom's equity base went up by 37.44% during the same period to reach Php 66.57 billion in 2017.

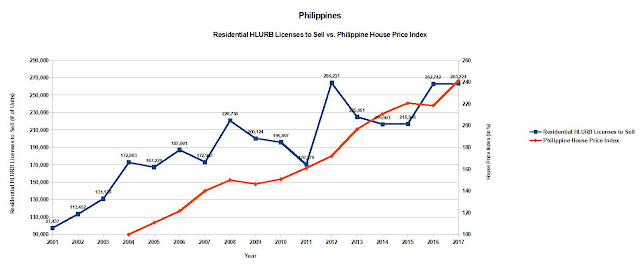

Exploding Internet

This "harvesting" of dividends took place at a time internet penetration rates exploded. From 2011 to 2016, Internet penetration per 100 persons almost tripled from 1.88 to 5.46.

|

| Source: World Bank |

|

|

More and more people experienced the internet through their mobile phones rather than fixed lines.

Naturally, the exploding demand for internet required massive investments in broadband infrastructure, which the telcos failed to provide.

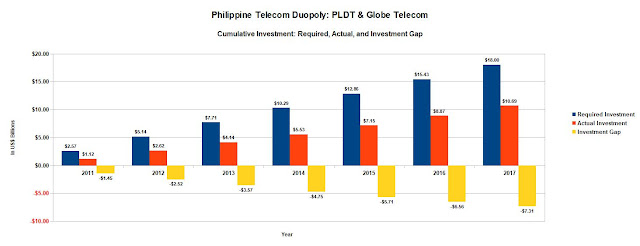

Edgardo Cabarios, the director of the Regulation Branch of the National Telecommunications Commission (NTC) said that the country needed to invest "Php 800 billion (US$ 18 billion) on its broadband infrastructure but the private sector is only investing Php 60 to Php 70 billion (US$ 1.4 to US$ 1.6 billion) a year."

Given that the life-cycle of internet communications technologies is at most seven years (and may be even faster), this investment translates to a required investment per year of US$ 2.57 billion a year. What the telcos actually spent fell far short of that. They were under-investing to the tune of over US$ 1.0 billion a year.

This gap between the required actual investment is real, cumulative, and growing. If the required capex had begun in 2011 (and there is no reason not to believe that given the rapid propagation of smartphones since 2007 and the global commercialization of 4G LTE technology in 2009), the telcos spent a total of US$ 10.69 billion or US $ 7.31 billion short of the required US$ 18.00 billion investment.

Much of this investment gap could have been eliminated from the get go had the telcos been less "extractive". The dividends distributed to shareholders is almost a mirror image of the investment gap the telcos faced. Had the telcos plowed their earnings back into their companies, the cumulative investment gap would be a paltry US$ 0.61 billion today. This is an amount they could have easily raised from borrowings because their equity base would have been almost three times larger than it is today.