In 2017, the Canadian Housing Market peaked in the second quarter of 2017. Since then, prices have declined modestly, by just 5.28% as of the first quarter of 2019. So, the housing market has slowed down and not quite reached correction levels of a 10% decline.

House

prices could still fall by 28.00% to align themselves with the growth in personal disposable incomes. In terms of the ratio of real house prices to real

personal disposable incomes, house prices have fallen even more: 7.70% from Q2 of 2017 to Q1 of 2019. The ratio is now

almost within two standard deviations from the historical mean. In other

words, they less extremely overvalued and are just starting to enter merely overvalued territory. The

probability of house prices being any higher is now only 1.35%

instead of 1.30% the last time we looked. The improvement is infinitesimally small.

If the ratio does revert to the mean, house prices could fall by 31.56%.

How low can Canadian Property Prices Go?

How Overheated are the Real Estate Markets of Canada, Australia, and New Zealand?

Search This Blog

Wednesday, July 31, 2019

Saturday, July 27, 2019

It's Official: Economic Recovery in the Great Depression is Faster than the Great Recession's

The economic recovery of the Great Recession has been almost

imperceptible to most Americans. On a per capita bais, real GDP per

Capita grew by 11.55% in the past twelve years - or roughly a compounded

annual average growth rate of only 0.91% per annum. This is far less

than the so-called "Hindu Rate of Growth" threshold of 1.30% per annum. This growth rate is so slow that it is almost imperceptible.

In 2019, something extraordinary happened. Those who survived the Great Depression in 1941 (twelve years after the onset of the Great Depression) will be substantially better of than the survivors of the Great Recession in 2019. Real GDP Per Capita for Great Recession survivors would have grown by another anemic 0.91% per annum in 2019. But for survivors of the Great Depression era, their incomes per capita would have grown by an astounding 15.95% in just one year. Moreover, that trend will only accelerate in the next two years. By 1943, Great Depression survivors will be almost 34.48% richer than they were in 1941.

Can we expect the same for survivors of the Great Recession in the next two years? It's possible but not probable.

In 2019, something extraordinary happened. Those who survived the Great Depression in 1941 (twelve years after the onset of the Great Depression) will be substantially better of than the survivors of the Great Recession in 2019. Real GDP Per Capita for Great Recession survivors would have grown by another anemic 0.91% per annum in 2019. But for survivors of the Great Depression era, their incomes per capita would have grown by an astounding 15.95% in just one year. Moreover, that trend will only accelerate in the next two years. By 1943, Great Depression survivors will be almost 34.48% richer than they were in 1941.

Can we expect the same for survivors of the Great Recession in the next two years? It's possible but not probable.

Wednesday, July 24, 2019

When Does the Overheated Real Estate Market of Australia Reach Equilibrium?

Last year, the real estate bust hit Australia. Prices have declined 8.27% since they peaked in the last quarter of 2017. But the decline is still a shade below a 10% correction and has not yet reached bear market proportions of a decline of 20% or more.

House prices could still fall by 38.56% to reach their inflation-adjusted levels. In relation to incomes, the ratio of real house prices to real personal disposable incomes have fallen significantly. That ratio is now within two standard deviations from the historical mean. In other words, they are now just overvalued and not extremely overvalued. The probability of house prices being any higher is now a healthier 5.22% instead of 1.4% the last time we looked.

If the ratio does revert to the mean, house prices could still fall by 30.67% in real terms.

How low can Australian Property Prices Go? Let Me Count the Ways

How Overheated are the Real Estate Markets of Canada, Australia, and New Zealand?

House prices could still fall by 38.56% to reach their inflation-adjusted levels. In relation to incomes, the ratio of real house prices to real personal disposable incomes have fallen significantly. That ratio is now within two standard deviations from the historical mean. In other words, they are now just overvalued and not extremely overvalued. The probability of house prices being any higher is now a healthier 5.22% instead of 1.4% the last time we looked.

If the ratio does revert to the mean, house prices could still fall by 30.67% in real terms.

How low can Australian Property Prices Go? Let Me Count the Ways

How Overheated are the Real Estate Markets of Canada, Australia, and New Zealand?

Saturday, July 20, 2019

Why is Job Growth Much Faster For Foreign-Born Workers Than For Native-Born Workers?

One reason. It's all about the money. Wages for foreign-born workers are but a fraction of wages for native-born workers. The difference is stark: $21K for foreign-born workers vs. $95K for native-born workers. In other words, native-born workers earn almost five times foreign-born workers.

Wednesday, July 10, 2019

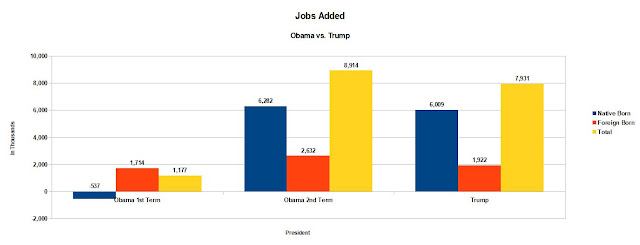

Who added more jobs? Trump or Obama: June 2019

Obama added more than 10.1 million jobs over two terms, or roughly 105.1K jobs per month. The trouble is, Obama added almost as many jobs to foreigners as he did to native born workers. Forty-three percent of the jobs added went to foreigners.

This ratio was much worse for Obama during his first term: 1.7 million of the jobs added went to foreign born workers. The native born? They lost 537K jobs. In other words, 146% of the jobs went to foreigners.

Obama's second term was much better for native born workers: 70% of the jobs went to them. But it was too late. It was not enough to stem the anti-immigration sentiment that had been building up nationwide. When Trump had announced his candidacy on May 2015 on a vehemently anti-immigrant platform, the jobs growth was still definitely skewed to foreign born workers. They had gained almost 2 million jobs and the native born workers had just gained 237K jobs.

Trump has continued the trend, adding almost 8 million jobs in 29 months, with around 75% of the jobs going to native born workers. Nevertheless, the trend towards hiring foreign born workers continues unabated. The cumulative jobs added to foreign born workers as a percentage to their Civilian Noninstitutional Population was an astounding 10.50% as of June 2019. Native Born workers just gained 3.15% for the same period.

Source: www.bls.gov, https://fred.stlouisfed.org

This ratio was much worse for Obama during his first term: 1.7 million of the jobs added went to foreign born workers. The native born? They lost 537K jobs. In other words, 146% of the jobs went to foreigners.

Obama's second term was much better for native born workers: 70% of the jobs went to them. But it was too late. It was not enough to stem the anti-immigration sentiment that had been building up nationwide. When Trump had announced his candidacy on May 2015 on a vehemently anti-immigrant platform, the jobs growth was still definitely skewed to foreign born workers. They had gained almost 2 million jobs and the native born workers had just gained 237K jobs.

Trump has continued the trend, adding almost 8 million jobs in 29 months, with around 75% of the jobs going to native born workers. Nevertheless, the trend towards hiring foreign born workers continues unabated. The cumulative jobs added to foreign born workers as a percentage to their Civilian Noninstitutional Population was an astounding 10.50% as of June 2019. Native Born workers just gained 3.15% for the same period.

Source: www.bls.gov, https://fred.stlouisfed.org

Saturday, July 6, 2019

Why There Is Still No Wage Inflation: There are 8.1 Million Missing American Workers

Last year, we pointed out that there would be little to no wage inflation because there were still 8 million American workers missing from the labor force. That was when the unemployment rate was at 4.1% as of February 2018. Today, as of June 2019, the unemployment rate is even lower still - a decades low 3.7% and there is still no wage inflation.

Yes, wages are rising but at less than a measly $0.75 gain a year while the inflation rate has been hovering at around 2% for the past ten years.

The reason for this? Labor Force Participation Rates (LFPR) and Employment-Population Ratios (EPR) have yet to recover their Pre-Recession peak.

If the June 2019 LFPR had reached their pre-recession peak of 66.0%, the US would have roughly 8.1 million more workers in the labor force than it has now. Likewise, if the June 2019 EPR had reached their pre-recession peak of 62.9%, the US would have roughly 6.0 million more people employed than it has now.

This means that the millions of people who disappeared from the labor force during the Great Recession are starting to reappear and get jobs and that has held wages down. The gains in LFPR and EPR have been very gradual, and at this rate, it may take years, if not decades for the economy to finally recover.

There Are Still Almost 8 Million Missing American Workers

Yes, wages are rising but at less than a measly $0.75 gain a year while the inflation rate has been hovering at around 2% for the past ten years.

The reason for this? Labor Force Participation Rates (LFPR) and Employment-Population Ratios (EPR) have yet to recover their Pre-Recession peak.

If the June 2019 LFPR had reached their pre-recession peak of 66.0%, the US would have roughly 8.1 million more workers in the labor force than it has now. Likewise, if the June 2019 EPR had reached their pre-recession peak of 62.9%, the US would have roughly 6.0 million more people employed than it has now.

This means that the millions of people who disappeared from the labor force during the Great Recession are starting to reappear and get jobs and that has held wages down. The gains in LFPR and EPR have been very gradual, and at this rate, it may take years, if not decades for the economy to finally recover.

There Are Still Almost 8 Million Missing American Workers

Subscribe to:

Posts (Atom)