The short answer is: yes. Throughout the ASEAN region, incomes have risen together with house prices. The only exception is Thailand, where house prices have underperformed both incomes as well as inflation. As of 2015, the Thailand House Price Index is only 15.13% higher than where it was as of year-end 2004. Incomes, as measured by GDP Per Capita, are 120% higher than they were during the same period. General prices are 33.84% higher than they were for the same period.

In all the other countries, incomes have outpaced house prices as well as inflation. However, in certain countries, the gap between incomes and house prices is narrowing. In Malaysia, incomes fell in 2015 to such an extent that only a 16.38% gap exists between incomes and house prices. The GDP per capita index now stands at 243.88 while house price index is at 227.50 as of 2015.

In Singapore, that gap between incomes and house prices is now only 20.66 percentage points.

In Indonesia, the gap between incomes and inflation has narrowed considerably. It is only 10.02% percentage points. But the gap between incomes and house prices remains stubbornly wide: 37.95% percentage points.

In the Philippines, incomes have outpaced house prices by a large margin 47.89% percentage points as of 2015. The gap between incomes and inflation is even larger: 107.96% percentage points.

This indicates that ASEAN house prices, in general, may have more room to run if incomes continue to grow and that growth is evenly distributed. As in most emerging economies, income and wealth inequality is rampant, especially in the Philippines. Read: One Major Reason for the Rise of the Vulgarian Rodrigo Duterte: Wealth Inequality

Search This Blog

Friday, April 28, 2017

Friday, April 14, 2017

What Gives in the Philippine Real Estate Market? Sales Volumes Are Up Yet House Prices Decline in 2016

According to the HLURB, sales volume increased by a dramatic 17.59% to reach 255,115 units sold in 2016 from only 216,503 units sold in 2015. Yet prices stayed flat or declined slightly year-on-year in 2016. The Philippine House Price Index, computed from changes in house prices in the Makati CBD as published in the Global Property Guide, fell by a slight 0.75% from year-end 2015 to reach 218.47 in 2016.

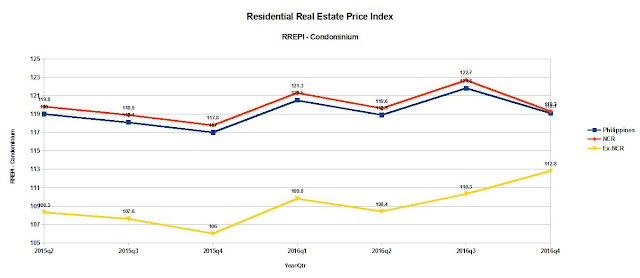

According to the Residential Real Estate Price Index put out by the BSP, prices for all types of housing grew by a marginal 0.3% year-on-year 2016, the slowest pace since the index came out in the second quarter of 2015.

Metro Manila saw a significant 8.6% year-on-year decline in the single detached housing market. In areas outside the NCR, the decline was marginal - only 0.18% in 2016. Overall, the market for single detached homes declined by 1.00% in 2016.

Price declines in the duplex market were also very significant, droppng 12.32% in 2016 alone. The NCR singlehandedly contributed to this decline, dropping 8.80% in 2016, more than offsetting all of the gains in duplex prices outside Metro Manila, which grew by a respectable 5.50% in 2016.

The townhouse market remained healthy. Townhouse prices increased by 6.24% in 2016 overall. But almost all of this increase came outside Metro Manila. Ex-NCR, townhouse prices increased by 16.31% in 2016. In the NCR, townhouse prices increased by a barely perceptible 0.08% in 2016.

Ex-NCR was also the bright spot in the condominium market. Outside the NCR, condo prices increased by 6.24% in 2016. NCR condo prices also grew, albeit more slowly: 1.27% in 2016, bringing up the Philippine average by 1.79% in terms of condo prices in 2016.

Much of the growth, therefore, is coming not from the over-saturated NCR, but from outside of it, indicating that the benefits of economic growth are spreading out to the rest of the Philippine economy, which could result in a much healthier real estate market.

According to the Residential Real Estate Price Index put out by the BSP, prices for all types of housing grew by a marginal 0.3% year-on-year 2016, the slowest pace since the index came out in the second quarter of 2015.

Metro Manila saw a significant 8.6% year-on-year decline in the single detached housing market. In areas outside the NCR, the decline was marginal - only 0.18% in 2016. Overall, the market for single detached homes declined by 1.00% in 2016.

Price declines in the duplex market were also very significant, droppng 12.32% in 2016 alone. The NCR singlehandedly contributed to this decline, dropping 8.80% in 2016, more than offsetting all of the gains in duplex prices outside Metro Manila, which grew by a respectable 5.50% in 2016.

The townhouse market remained healthy. Townhouse prices increased by 6.24% in 2016 overall. But almost all of this increase came outside Metro Manila. Ex-NCR, townhouse prices increased by 16.31% in 2016. In the NCR, townhouse prices increased by a barely perceptible 0.08% in 2016.

Ex-NCR was also the bright spot in the condominium market. Outside the NCR, condo prices increased by 6.24% in 2016. NCR condo prices also grew, albeit more slowly: 1.27% in 2016, bringing up the Philippine average by 1.79% in terms of condo prices in 2016.

Much of the growth, therefore, is coming not from the over-saturated NCR, but from outside of it, indicating that the benefits of economic growth are spreading out to the rest of the Philippine economy, which could result in a much healthier real estate market.

Labels:

All Types,

BSP,

Condominiums,

Duplex,

HLURB,

National Capital Region,

NCR,

Real Estate,

Real Estate Bubble,

Residential Real Estate Price Index,

RREPI,

Single Detached,

Townhouse

Friday, April 7, 2017

Singapore Continues its Controlled Slide of House Prices While Philippine House Prices Decline Slightly in 2016

Almost all countries discussed in this blog post, with the exception of Thailand, have been experiencing rapid growth in home prices that have outstripped inflation by a wide margin. The gap between home prices and their inflation adjusted levels are at the widest ever, particularly in Singapore, Hong Kong, and the Philippines.

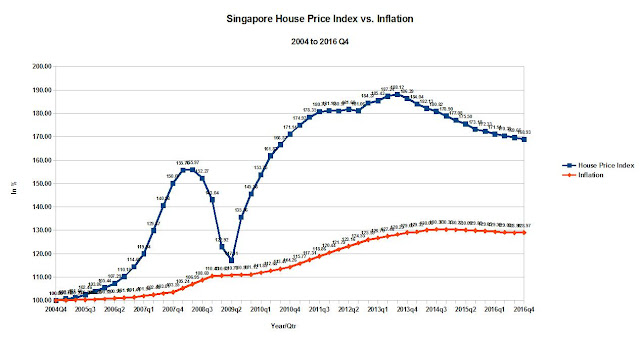

Singapore

Singapore's home prices have now been declining for thirteen straight quarters, which, according to Bloomberg, is the longest losing streak in five years. Home prices are still 68.93% above their year-end 2004 levels. Overall prices levels, as measured by inflation have just increased by 28.97% since year end 2004. In other words, for the past ten years, Singaporean home prices have outpaced inflation by almost than 40 percentage points.

Malaysia

Neighboring Malaysia's House Price Index now stands at 235.06 as of the third quarter 2016, 135.06% higher than year-end 2004 levels. General price levels as of the third quarter 2016 are only around 34.15% higher than their year end 2004 levels.

Thailand

In Thailand, which has been experiencing political turmoil for some time, home prices have remained essentially flat since the end of 2004. Home Prices ended 2013 with the index at 100.54, just 0.54% higher than the end of 2004, but showing a substantial recovery since the recent low of 74.08 posted in the third quarter of 2009. Since 2013, home prices have rebounded to 114.69 or 14.69% higher than its year-end 2004 levels, way below its expected inflation adjusted levels. General Price levels are 34.09% above their year-end 2004 levels. In other words, Thailand Home Prices have lagged inflation by as much as 19.40% since their year-end 2004 levels.

Indonesia

Meanwhile, in Indonesia, home prices have shown no signs of slowing down their upward trajectory. In fact, prices are now at 146.88 or 46.88% above their first quarter 2007 levels. Inflation, however, has marched higher. General prices are 75.92% above first quarter 2007 levels, lagging inflation by 29.04%.

Philippines

Philippine house price index stands at 218.47% as of year-end 2016 or over 118.48% above their year-end 2004 levels. Philippine home prices have posted one of the largest 10 year gains among all the countries considered in this blog post. Philippine home prices have outstripped inflation by more than fifty percentage points. General prices stood at 163.35% or 63.35% above their year-end 2004 levels. Like Indonesia, Philippine home prices have so far no signs of slowing down their upward trajectory for the foreseeable future. The question is, is this momentum sustainable? Or will the Philippines and Indonesia follow its ASEAN neighbors, Singapore, Malaysia, and Thailand, in exhibiting plateauing or declining house prices? That remains to be seen.

Singapore

Singapore's home prices have now been declining for thirteen straight quarters, which, according to Bloomberg, is the longest losing streak in five years. Home prices are still 68.93% above their year-end 2004 levels. Overall prices levels, as measured by inflation have just increased by 28.97% since year end 2004. In other words, for the past ten years, Singaporean home prices have outpaced inflation by almost than 40 percentage points.

Malaysia

Neighboring Malaysia's House Price Index now stands at 235.06 as of the third quarter 2016, 135.06% higher than year-end 2004 levels. General price levels as of the third quarter 2016 are only around 34.15% higher than their year end 2004 levels.

Thailand

In Thailand, which has been experiencing political turmoil for some time, home prices have remained essentially flat since the end of 2004. Home Prices ended 2013 with the index at 100.54, just 0.54% higher than the end of 2004, but showing a substantial recovery since the recent low of 74.08 posted in the third quarter of 2009. Since 2013, home prices have rebounded to 114.69 or 14.69% higher than its year-end 2004 levels, way below its expected inflation adjusted levels. General Price levels are 34.09% above their year-end 2004 levels. In other words, Thailand Home Prices have lagged inflation by as much as 19.40% since their year-end 2004 levels.

Indonesia

Meanwhile, in Indonesia, home prices have shown no signs of slowing down their upward trajectory. In fact, prices are now at 146.88 or 46.88% above their first quarter 2007 levels. Inflation, however, has marched higher. General prices are 75.92% above first quarter 2007 levels, lagging inflation by 29.04%.

Philippines

Philippine house price index stands at 218.47% as of year-end 2016 or over 118.48% above their year-end 2004 levels. Philippine home prices have posted one of the largest 10 year gains among all the countries considered in this blog post. Philippine home prices have outstripped inflation by more than fifty percentage points. General prices stood at 163.35% or 63.35% above their year-end 2004 levels. Like Indonesia, Philippine home prices have so far no signs of slowing down their upward trajectory for the foreseeable future. The question is, is this momentum sustainable? Or will the Philippines and Indonesia follow its ASEAN neighbors, Singapore, Malaysia, and Thailand, in exhibiting plateauing or declining house prices? That remains to be seen.

Subscribe to:

Posts (Atom)