The reported unemployment rate during the Great Depression was significantly higher than the reported unemployment rates of the Great Recession.

But are the two rates comparable? Before 1938, children were a significant part of the labor force. In 1900, children younger than sixteen made up as much as eighteen percent of the labor force. It was only when the Fair Labor Standards Act of 1938 became law that children younger than sixteen were barred from working in manufacturing and mining but not agriculture.

To make the numbers more comparable, it is better to get the ratio of Employment to the Total Population (which includes children). When we do this, the two measures are not so far apart. In 1929, the year "0" for the Great Depression, 54.41% of the total population was employed. By 1933, year "4", only 41.97% of the population was employed. But the rise in employment was dramatic. Four years later, 47.63% of the population was employed, almost six percentage points higher. The employment momentum only stalled when the tax hikes of 1937 induced another recession in 1938 and new child labor laws barred children from the labor force. If the momentum had continued, the employment ratio would have recovered in less than five years.

In 2007, the year "0" of the Great Recession, 48.38% of the population was employed. Four years later, only 44.82% of the population was employed, a drop of less than 4 percentage points. By February 2016 or four years after the Great Recession bottomed out, only 46.76% of the population is employed, an increase of only 2.07% percentage points. The growth rate of employment was less than a third that of the Great Depression. At this rate, it will take four more years or 2020 before employment recovers to that of Year "0".

Great Depression vs. Great Recession

Source: www.worldbank.org, www.bea.gov, www.bls.gov, Reinhart and Rogoff, "This Time is Different"

Search This Blog

Friday, March 25, 2016

Great Depression vs. Great Recession: Unemployment - Updated February 2016

Friday, March 18, 2016

Looks like Australia's Housing Market is about to go Bust!

Judging from this Australian edition of 60 Minutes, Australia seems to be undergoing a massive housing boom, fueled, no doubt, by cheap money and lax credit standards, echoing the subprime crisis in the United States.

This has shown up in the charts, as pictured below. In a little over 12 years, house prices in Australia have massively outstripped inflation by 135 percentage points, from a base of 100.00 in the last quarter of 2002 to 268.59 in the third quarter of 2015. In the same time period, general consumer prices rose from a base of 100.00 to 133.0 as of the third quarter of 2015. The gap between Australian House Prices vs Inflation is one of the largest seen in recent history. Only Hong Kong has developed a higher gap in a slightly shorter time frame.

Given that the Australian Housing Bubble is beginning to pop, the country could experience massive declines in house prices, similar to what happened in the US. The US House Price Index peaked at 135.81 in the first quarter of 2007, then declined by over 20% to bottom out at 107.74 on the second quarter of 2011. This was almost 10 percentage points below inflation adjusted level of 117.39 at that time. Since then, US Housing prices have rebounded past inflation adjusted levels and the index is now at 134.27 as of the third quarter of 2015 while inflation adjusted levels remain at 125.60.

Sources: 60 Minutes Australia, Global Property Guide, www.worldbank.org, Trading Economics

Saturday, March 12, 2016

Singapore, Malaysia, and Thailand Post Flat to Declining Housing Prices, Can the Philippines and Indonesia be Not Far Behind? - 3rd Qtr 2015

Almost all countries discussed in this blog post, with the exception of Thailand, have been experiencing rapid growth in home prices that have outstripped inflation by a wide margin. The gap between home prices and their inflation adjusted levels are at the widest ever, particularly in Singapore, Hong Kong, and the Philippines.

Singapore

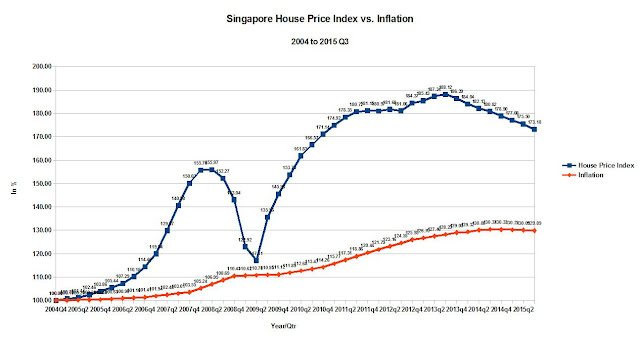

Singapore's home prices have now been declining for seven straight quarters, which, according to Bloomberg, is the longest losing streak in five years. Home prices are still 73.18% above their year-end 2004 levels. Overall prices levels, as measured by inflation have just increased by 29.89% since year end 2004. In other words, for the past ten years, Singaporean home prices have outpaced inflation by more than 40 percentage points.

Malaysia

Neighboring Malaysia's House Price Index actually topped out at 182.14 in the fourth quarter of 2014 and has declined to 181.68 as of the third quarter of 2015. Home prices are 81.68% above their year-end 2004 levels. General price levels are almost 50 percentage points lower, at 31.91% above their year-end 2004 levels.

Thailand

In Thailand, which has been experiencing political turmoil for some time, home prices have remained essentially flat since the end of 2004. Home Prices ended 2013 with the index at 100.54, just 0.54% higher than the end of 2004, but showing a substantial recovery since the recent low of 74.08 posted in the third quarter of 2009. In the third quarter of 2015, home prices have rebounded to 108.63, or 8.63% higher than its year-end 2004 levels, way below its expected inflation adjusted levels. General Price levels are 34.13% above their year-end 2004 levels.

Singapore

Singapore's home prices have now been declining for seven straight quarters, which, according to Bloomberg, is the longest losing streak in five years. Home prices are still 73.18% above their year-end 2004 levels. Overall prices levels, as measured by inflation have just increased by 29.89% since year end 2004. In other words, for the past ten years, Singaporean home prices have outpaced inflation by more than 40 percentage points.

Malaysia

Neighboring Malaysia's House Price Index actually topped out at 182.14 in the fourth quarter of 2014 and has declined to 181.68 as of the third quarter of 2015. Home prices are 81.68% above their year-end 2004 levels. General price levels are almost 50 percentage points lower, at 31.91% above their year-end 2004 levels.

Thailand

In Thailand, which has been experiencing political turmoil for some time, home prices have remained essentially flat since the end of 2004. Home Prices ended 2013 with the index at 100.54, just 0.54% higher than the end of 2004, but showing a substantial recovery since the recent low of 74.08 posted in the third quarter of 2009. In the third quarter of 2015, home prices have rebounded to 108.63, or 8.63% higher than its year-end 2004 levels, way below its expected inflation adjusted levels. General Price levels are 34.13% above their year-end 2004 levels.

Indonesia

Meanwhile in Indonesia, home prices have showed no signs of slowing down their upward trajectory. In fact, prices seem to have gone parabolic, climbing 4.63% in the last quarter of 2013, from a base of 121.49 as of the third quarter of 2013 to 127.11 as of year end 2013. In the third quarter of 2015, home prices have climbed an additional 13.78% to reach 140.81. Since the first quarter of 2007, home prices have risen 40.89%. Indonesian Home Prices, like Thailand, have lagged inflation since 2007.

Hong Kong

Hong Kong real estate prices have leaped by 250.31% in a little over 10 years to reach a staggering 350.31 as of the third quarter of 2015 from a base of 100 since year-end 2004. General inflation levels have just climbed 38.66% during this same period. In other words, Hong Kong home prices have outpaced inflation by an astounding 211.65% during this period, the highest rate of appreciation in the countries covered in this post.

Philippines

Philippine house price index stands at 220.11 at the end of the third quarter 2015 or over 120.11% above their year-end 2004 levels. Philippine home prices, with the exception of Hong Kong, have posted the largest 10-year gains among all the countries considered in this blog post. Like Singapore and Malaysia, Philippine home prices have outstripped inflation by around sixty percentage points. Like Indonesia and Hong Kong, Philippine home prices have so far no signs of slowing down their upward trajectory for the foreseeable future. The question is, is this momentum sustainable? Or will the Philippines and Indonesia follow its ASEAN neighbors, Singapore, Malaysia, and Thailand, in exhibiting plateauing or declining house prices? That remains to be seen.

Source: Global Property Guide, Trading Economics

Saturday, March 5, 2016

Philippine Real Estate and Construction Loans Are Out of Whack As of December 2015!

It sure looks that way, judging from this chart:

It looks like Real Estate and Construction Loans as a percentage of Total Loan Portfolio (TLP) rocketed past its historical range of 12.6% to 16.6% of TLP sometime in 2011. That ratio peaked at 20.55% as of September 2013 but has bottomed out at 18.61% of TLP as of December 2014. In 2015, this ratio has climbed back up to 19.59% as of December 2015.

Now, are we up to the levels of the previous real estate boom? (as in mid 1990s to 1997?) Honestly, we don't know. BSP data only goes as far back as 1999 when the previous real estate bubble had already burst and the financial system was most likely deleveraging as evidenced in this chart.

Philippine Real Estate and Construction Loans Are Even More Out of Whack As of September 2015!

Has the Philippine Real Estate Bubble Already Burst?

Is There a Real Estate Bubble in the Philippines?

Are Philippine Real Estate Loans Out of Whack?

It looks like Real Estate and Construction Loans as a percentage of Total Loan Portfolio (TLP) rocketed past its historical range of 12.6% to 16.6% of TLP sometime in 2011. That ratio peaked at 20.55% as of September 2013 but has bottomed out at 18.61% of TLP as of December 2014. In 2015, this ratio has climbed back up to 19.59% as of December 2015.

Now, are we up to the levels of the previous real estate boom? (as in mid 1990s to 1997?) Honestly, we don't know. BSP data only goes as far back as 1999 when the previous real estate bubble had already burst and the financial system was most likely deleveraging as evidenced in this chart.

Philippine Real Estate and Construction Loans Are Even More Out of Whack As of September 2015!

Has the Philippine Real Estate Bubble Already Burst?

Is There a Real Estate Bubble in the Philippines?

Are Philippine Real Estate Loans Out of Whack?

Subscribe to:

Posts (Atom)